HIGHLIGHTS

1. Employment impact from COVID-19 is unprecedented

2. CARES Act will mitigate some of the losses

3. This is not a real estate lead recession like 2008

4. Local real estate impact proportional to jobs impact and recovery

5. Long term, LV, STG, SLC will grow

6. Better solutions for virtual showings will proliferate

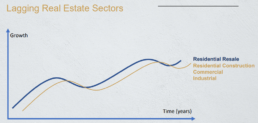

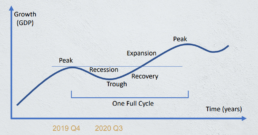

In March, COVID-19 was an unexpected an unprecedented shock to the global economy. While in the early stages, it seemed the United States would be minimally impacted, the global pandemic created a health crisis and economic crisis that immediately put the United States economy in recession. Fast, liquid markets like equities, bonds, and commodities responded quickly to economic news. Markets such as residential and commercial real estate take more time to absorb information and for market participants to respond.

While the impacts of COVID-19 on real estate markets are unknown and hard to predict, we believe the underlying fundamentals of the real estate markets between Salt Lake and Las Vegas are strong. Although short term fluctuations will occur, a longer-term perspective points to growing population, additional construction, and moderately rising prices. Following is a discussion of residential real estate markets between Salt Lake and Las Vegas.

Pre COVID-19 Real Estate Fundamentals

Going into March of 2019, real estate fundamentals were strong. Housing inventories were low, interest rates were low, price appreciation was moderate, and the job market and the economy were strong. New construction, although at decade highs, was still 30-40% below the 2005 construction peak. Home sales started out well ahead of first quarter 2019. Households were carrying less debt and lower payments than leading up to the 2008 housing bust.

Current Conditions

Closing the economy did not close real estate markets. Although real estate open houses have ended and traditional showings fell by 60% and are starting to slowly recover, closed transaction have not been impacted nearly so significantly. While April and May will see fewer closings than the same month last year, we expect to be 20-30% below 2019 this spring with units beginning to improve as the economy opens this summer. Full year 2020 units may not match 2019 levels, but real estate markets will be very active in 2020.

COVID-19 Impacts and Response

In an effort to protect the public and prevent overwhelming our healthcare systems, Federal, State, and Local governments asked everyone who could to stay home. This response closed businesses and introduced us to social distancing. The resulting impact resulted in over 24 million jobs lost through April 23rd with more to come.

The Intermountain West has relatively few cases of COVID-19, but the economic impact has been significant, particularly Las Vegas where hospitality, conventions, entertainment, and tourism are closed. Job losses in these sectors will be slower to return than many others who will see customers return relatively quickly.

The United States Government has passed two stimulus packages totaling $2.5 trillion targeting individuals, small businesses, large businesses, and state governments. If the United States economy sees a full year reduction in economic activity of 10%, that would result in $2.1 trillion in economic loss ($21 trillion economy * 10%). To date, the government response has been proportional to the expected economic impact. These stimulus efforts will help, but they do not compensate for the loss of life and individual economic loss that many will feel as a result of the pandemic.

Looking Long-Term

We are fortunate to live in places with strong long-term growth fundamentals, reasonable cost of living, exceptional access to outdoors and open space, and vibrant economies. While there will be significant short-term impacts from COVID-19, in the long run Salt Lake City and surrounding areas, St. George, and Las Vegas will be great places to live and work. They will rebound economically and continue to grow as the fundamentals that have made these locations great for the past 40 years overwhelm the recent impacts of COVID-19 and its economic impacts.

Real estate markets will adapt as buyers and sellers demand and more quickly adopt technologies that support showings, transactional paperwork and closing. Making decisions and having a professional advisor will continue to be a critical part of succeeding in real estate markets for the foreseeable future. Real estate professionals who embrace exceptional customer service will be rewarded. Those who revert to sales tactics of the past will slowly be left behind.

Summary

The employment impact of COVID-19 is unprecedented. The United States government has responded with a support package that is also unprecedented in scope and the speed in which it was delivered. While not perfect, it was designed to be proportional to the economic harm. Going into the recession, housing markets were very stable with strong fundamentals, reducing the likelihood that housing is impacted similar to last recession. Local real estate impacts will be proportional to jobs impact and subsequent recovery. In the long term, Las Vegas, St. George, and Salt Lake City will continue to grow because of the desirable characteristics that supported their economies prior to the arrival of the pandemic. Finally, we expect the real estate industry and real estate professionals will adapt and innovate to ensure buyers and sellers receive the support and attention needed to transact successfully for years to come.