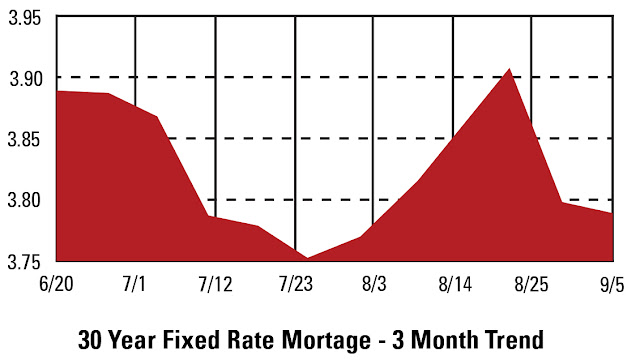

Mortgage rates dipped again this week as investors bought into the notion that the Federal Reserve is ready to provide more economic stimulus to lift the economy.

There’s no question Federal Reserve Chairman Ben Bernanke helped mortgage rates during his speech Friday in Jackson Hole, Wyo.

He did not provide any details about another round of stimulus at the event, but one vague statement was enough to fuel rumors that another bond-buying program is on the way.

“Taking due account of the uncertainties and limits of its policy tools, the Federal Reserve will provide additional policy accommodation as needed to promote a stronger economic recovery and sustained improvement in labor market conditions in a context of price stability,” Bernanke said.

After the speech, the yields on U.S. Treasury and mortgage bonds tumbled as the demand for these safer investments rose, says Bob Moulton, president of Americana Mortgage in Manhasset, N.Y.

“The fact that they are talking about another stimulus plan tells you that things are not as rosy as the government would like you to think,” he says.

To view the full story got to Bankrate.com

37.1100416-113.5788062